<script src="https://play.vidyard.com/embed/v4.js" async="" type="text/javascript"></script>

List of U.S minimum wage increases in 2018

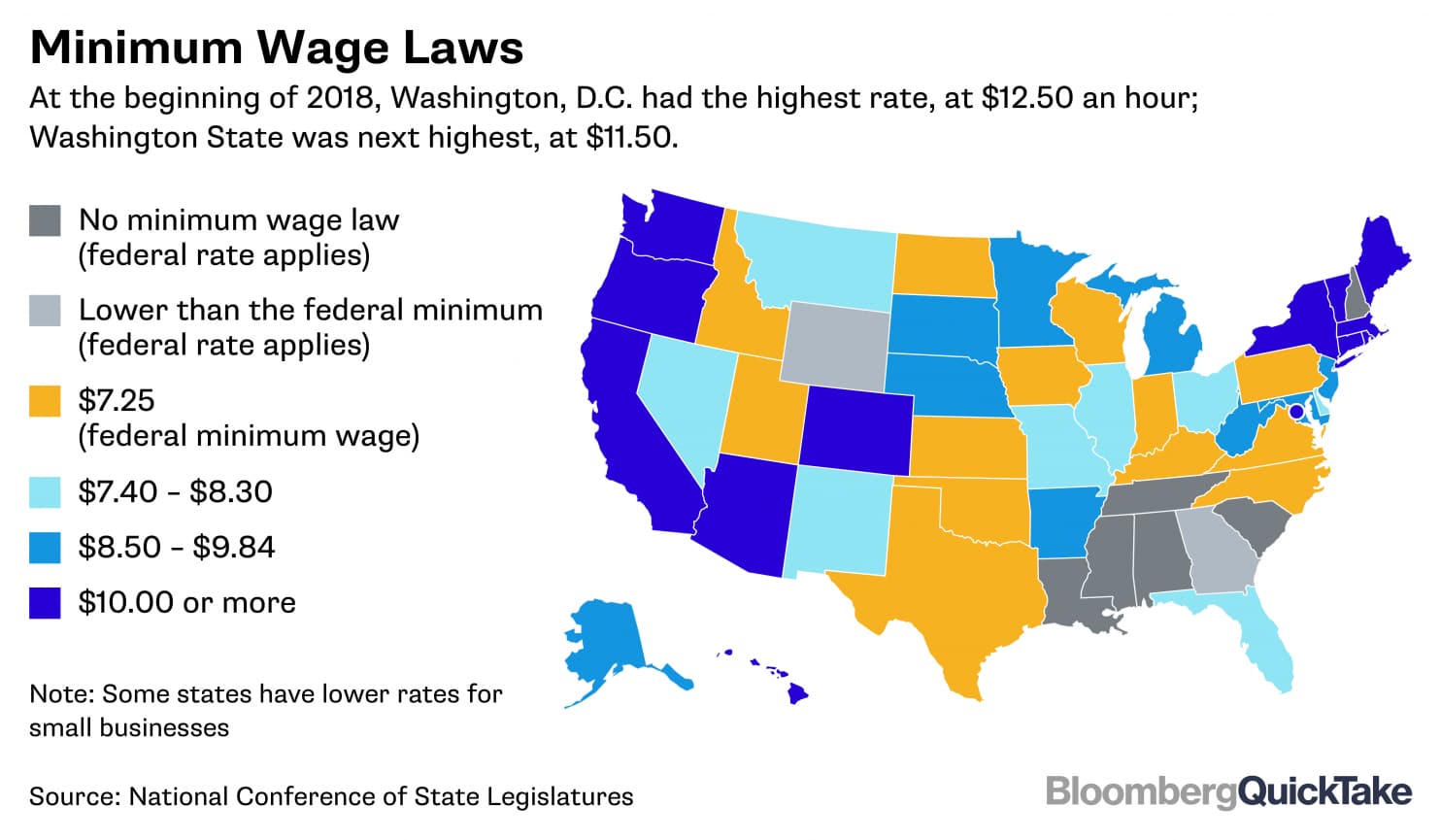

As we enter 2018, increases in the minimum wage laws in the United States have become a hot topic. Approximately 4.5 million low wage workers in 18 states saw an increase in their paychecks beginning New Year’s Day, 2018, as these wage hikes took effect. These states already had rates above the federal floor of $7.25 an hour.

A HuffPost YouGov poll last year found that more than half of all Americans thought a minimum wage raise would be good for workers, while only a third thought it would be a bad idea.

**F ederal Minimum Wage

**

The current federal minimum wage is $7.25 per hour and has not increased since July 2009. When the state, city or county minimum wage rate is higher than the federal rate, employers are required to pay workers the higher amount.

The debate around the federal floor is becoming more and more academic since not many Americans work for $7.25 an hour these days. According to the Washington Post, in 2016, just 2.7 percent of the country’s 79.9 million hourly workers earned that amount.

Notes:

In states with no minimum-wage law (Alabama, Louisiana, Mississippi, South Carolina, and Tennessee) or minimum wages below the federal minimum wage (Georgia and Wyoming), the federal minimum wage of $7.25 applies.

Watch this video to find out the 18 states with new minimum wages in 2018 (according to the Economic Policy Institute):

Alaska: $9.84 ($.04 increase)

Arizona: $10.50 ($.50 increase)

California: $11.00 ($.50 increase)

Colorado: $10.20 ($.90 increase)

Florida: $8.25 ($.15 increase)

Hawaii: $10.10 ($.85 increase)

Maine: $10.00 ($1.00 increase)

Michigan: $9.25 ($.35 increase)

Minnesota: $9.65 ($.15 increase)

Missouri: $7.85 ($.15 increase)

Montana: $8.30 ($.15 increase)

New Jersey: $8.60 ($.16 increase)

New York: $10.40 ($.70 increase)

Ohio: $8.30 ($.15 increase)

Rhode Island: $10.10 ($.50 increase)

South Dakota: $8.85 ($.20 increase)

Vermont: $10.50 ($.50 increase)

Washington: $11.50 ($.50 increase)

New York

New York’s minimum wage rate depends on the geographic location of the workplace, the size of the employer’s workforce, and the calendar. Since New York’s increases are complicated, here’s a separate breakdown of the minimum wage changes:

NYC non-fast food workers: $13 for large employers (up from $11) and $12 for small employers (up from $10.50)

Long Island and Westchester non-fast food workers: $11 (up from $10)

Upstate non-fast food worker:s $10.40 (up from $9.70)

NYC fast food workers: $13.50 (up from $12)

Fast food workers in the rest of the state, $11.75 (up from $10.75)

To read more about New York’s minimum wage changes, read this article:

<center><span id="hs-cta-wrapper-c40c1775-4317-4fdf-85f2-f148fdd81c1b" class="hs-cta-wrapper"><span id="hs-cta-c40c1775-4317-4fdf-85f2-f148fdd81c1b" class="hs-cta-node hs-cta-c40c1775-4317-4fdf-85f2-f148fdd81c1b"><a href="https://cta-redirect.hubspot.com/cta/redirect/3040938/c40c1775-4317-4fdf-85f2-f148fdd81c1b" target="_blank"><img id="hs-cta-img-c40c1775-4317-4fdf-85f2-f148fdd81c1b" class="hs-cta-img" style="border-width: 0px;" src="https://no-cache.hubspot.com/cta/default/3040938/c40c1775-4317-4fdf-85f2-f148fdd81c1b.png" alt="All About New York's Minimum Wage Changes"></a></span></span></center>

<center><span id="hs-cta-wrapper-c40c1775-4317-4fdf-85f2-f148fdd81c1b" class="hs-cta-wrapper"><script src="https://js.hscta.net/cta/current.js" charset="utf-8"></script><script type="text/javascript">// <![CDATA[ hbspt.cta.load(3040938, 'c40c1775-4317-4fdf-85f2-f148fdd81c1b', {}); // ]]></script></span></center>

Best Practice

The U.S. Department of Labor says 70 percent of companies are not compliant with wage and labor laws! It’s critical for U.S. businesses to be compliant with labor laws as the Department Of Labor regulatory enforcement and lawsuit spending is on the rise. Software and technology can help comply with these new wage and overtime rules through accurate employee tracking and reporting. Currently, New York, Vermont, New Hampshire, San Francisco and Emeryville, California, and Seattle, Washington all have predictive scheduling laws in place. To learn about how Deputy can help you to fulfill your responsibilities under these predictive scheduling laws, download our informative eBook below.

<center><span id="hs-cta-wrapper-3cd4921b-7a42-467f-8e8b-6b8f469c9088" class="hs-cta-wrapper"><span id="hs-cta-3cd4921b-7a42-467f-8e8b-6b8f469c9088" class="hs-cta-node hs-cta-3cd4921b-7a42-467f-8e8b-6b8f469c9088"><a href="https://cta-redirect.hubspot.com/cta/redirect/3040938/3cd4921b-7a42-467f-8e8b-6b8f469c9088" target="_blank"><img id="hs-cta-img-3cd4921b-7a42-467f-8e8b-6b8f469c9088" class="hs-cta-img" style="border-width: 0px;" src="https://no-cache.hubspot.com/cta/default/3040938/3cd4921b-7a42-467f-8e8b-6b8f469c9088.png" alt="Download Predictive Scheduling eBook"></a></span><script src="https://js.hscta.net/cta/current.js" charset="utf-8"></script><script type="text/javascript">// <![CDATA[ hbspt.cta.load(3040938, '3cd4921b-7a42-467f-8e8b-6b8f469c9088', {}); // ]]></script></span></center>

As an industry leader in workforce management and attendance tracking, Deputy has multiple solutions, including automated attendance recording, performance management, payroll & POS integrations, accurate location and time tracking, communication features, biometric face recognition, and custom reporting. Choosing the right workforce management technology can protect companies from fraud to major lawsuits.

By using Deputy’s cloud-based technology, businesses can easily manage their employees, adhere to compliance, and grow their bottom lines.  <script src="https://js.hscta.net/cta/current.js" charset="utf-8"></script><script type="text/javascript">// <![CDATA[ hbspt.cta.load(3040938, 'ecc53935-4be6-4c15-808f-2de325f16101', {}); // ]]></script> to see how much you could be saving on overtime, payroll, scheduling, time theft, and more. Take action today and join over 70,000+ business by signing up for a free 30-day trial:

<script src="https://js.hscta.net/cta/current.js" charset="utf-8"></script><script type="text/javascript">// <![CDATA[ hbspt.cta.load(3040938, 'ecc53935-4be6-4c15-808f-2de325f16101', {}); // ]]></script> to see how much you could be saving on overtime, payroll, scheduling, time theft, and more. Take action today and join over 70,000+ business by signing up for a free 30-day trial:

<center><span id="hs-cta-wrapper-39f681b8-1b56-4081-bb18-1b80e3fc6617" class="hs-cta-wrapper"><span id="hs-cta-39f681b8-1b56-4081-bb18-1b80e3fc6617" class="hs-cta-node hs-cta-39f681b8-1b56-4081-bb18-1b80e3fc6617"><a href="https://cta-redirect.hubspot.com/cta/redirect/3040938/39f681b8-1b56-4081-bb18-1b80e3fc6617" target="_blank"><img id="hs-cta-img-39f681b8-1b56-4081-bb18-1b80e3fc6617" class="hs-cta-img" style="border-width: 0px;" src="https://no-cache.hubspot.com/cta/default/3040938/39f681b8-1b56-4081-bb18-1b80e3fc6617.png" alt="START FREE TRIAL"></a></span><script src="https://js.hscta.net/cta/current.js" charset="utf-8"></script><script type="text/javascript">// <![CDATA[ hbspt.cta.load(3040938, '39f681b8-1b56-4081-bb18-1b80e3fc6617', {}); // ]]></script></span></center>

For more information about minimum wages across the country, visit epi.org.